The phase of the financial crisis proves quite frustrating that people find it difficult to get a feasible solution through which they can come out of the crisis. However, at this stage, the financial planners or mortgage advisers can really help you to work on a feasible solution. It is also true that sometimes a small amount of loan can give a new life to your business but getting a loan from a bank requires a strong guarantee which can ultimately put you in more trouble. The mortgage advisers in Northampton are can solve your financial problems as they hold expertise. Besides this, if you prefer to get a loan from an independent lender, the adviser helps in this regard too because they maintain good relations in the market and play a role of broker too.

Expert Opinion!

Advisers are persons who keep themselves attentive and active in the market and understand the economic cycle more deeply. So, when a person hires an adviser, the professional listens to him carefully and prepare a complete financial strategy that can help the client to overcome the financial issues. The expert mortgage advisers in Northampton work on feasible yet suitable solutions and assist the clients in adopting a reliable strategy.

Loan Approval!

If you get a loan on easy terms, it can surely prove helpful for overcoming the financial problems. However, most of the applicants fail to get the loan when they apply at their own but the mortgage advisers assist them regarding the accurate way of applying for a loan. Moreover, they give the option of independent lenders as well. So, a person can ultimately get a loan on easy terms if he asks an expert for the assistance.

Organized Planning!

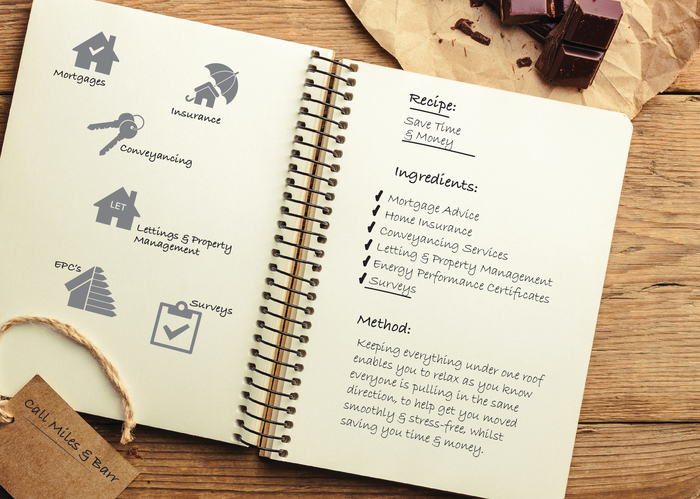

The mortgage brokers do all the chores in an organized way that proves beneficial for their clients as they work step by step and make sure the legal implications as well. However, if it is about letting out a property or buying a new house on the basis of instalments, the advisers provide a feasible plan for these issues too. Brokers charge a fixed commission but you put yourself on a safe side by paying a small fee.

Reliable Working!

The brokers do reliable working and give the best option to their clients. So, you should definitely make sure to outsource the mortgaging work to brokers as it will ultimately prove helpful for you.